On Oct. 3, 2019, the Greater Pine Island Civic Association (GPICA) filed a Letter of Intent to Incorporate with the Lee Board of County Commissioners, our state representatives, and the City of Cape Coral. This information, prepared by the GPICA Board in October 2019, answers some common questions about incorporation, provides references, and explains the incorporation process. For more information, please review “Why Incorporate.”

Download a PDF of these Frequently Asked Questions

Q: Will there be a formal vote on incorporation?

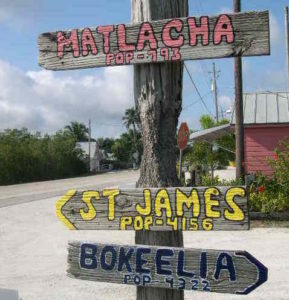

A: Yes. After a bill allowing incorporation is introduced and passed by the Florida legislature and signed by the Governor, all registered voters whose primary residence is within the proposed corporate boundaries of the Greater Pine Island Planning Community (Matlacha Isles, Matlacha, St. James City, Pine Island Center, Pineland, and Bokeelia) will have the opportunity to vote for or against incorporation.

Q: I own property in the Greater Pine Island Community. Why can’t I vote on incorporation?

A: Florida law allows only registered voters whose primary residence is in the proposed corporate boundaries of the Greater Pine Island Planning Community to vote for or against incorporation.

Q: What are the steps and timeline for the incorporation process?

A: Here is the current timeline as the GPICA Board envisions it:

- October 2019 Begin public education and discussion about the pros and cons of incorporation. This effort will continue throughout the process.

- October-November 2019 Produce a final draft of the Incorporation See the current draft here: gpica.org/draft-pi-charter

- 2020 Hold a nonbinding referendum for residents of the Greater Pine Island Planning Community to fairly and accurately gauge interest in incorporation. Legislators who agree to introduce the bill need to know there is sufficient support.

- November 2020 If the nonbinding referendum shows support for incorporation, that information, along with a feasibility study and draft Charter is submitted to the State. The Government Accountability Committee of the Florida House of Representatives reviews this material and decides whether the proposed community meets fiscal and other sufficiency rules under applicable state laws.

- January-March 2021 A bill to incorporate is introduced in the House; then, if passed, it is introduced in the Senate. If it passes there, it goes to the Governor for his signature.

- 2022 All registered voters within the Greater Pine Island Planning Community have the opportunity to vote on incorporation in the general election.

- January-March 2023 If voters approve incorporation, elections are held to vote for members of a governing Council.

Q: When would the Draft Charter become final?

A: The Charter becomes final when the legislature votes to approve the bill to incorporate and the Governor signs it into law. If the voters approve incorporation, the Charter then goes into effect.

Q: How will the new incorporated Village pay for services?

A: Currently the residents of the Greater Pine Island Planning Community pay nearly $1 million more per year in property taxes to Lee County than we receive in services — and the county keeps our excess tax dollars. If we incorporate, those excess tax dollars would come directly to our community. The Council would contract with Lee County or other entities to continue to provide police, emergency management, public works, parks and recreation, planning and zoning, building inspection, development review, animal control, and solid waste collection at current levels. The surplus would pay the cost of our local government and provide a rainy-day fund under our local control. According to the Matlacha-Pine Island Incorporation Feasibility Study (p. 18) “There will be no change in cost for all governmental and public utility services to the residents of Matlacha-Pine Island if it were to incorporate.” Source: gpica.org/feasibilitystudy2017.

Note: Water and fire are already provided by our own special districts and schools are funded by the Lee County School District. The County would retain responsibility for roads, transportation planning and sewers.

Q: Will my taxes go up if we incorporate?

A: It depends on the priorities of the new Village Council members elected by residents. In fact, taxes could even be lowered. According to the Matlacha-Pine Island Incorporation Feasibility Study (gpica.org/feasibilitystudy2017) “the Village of Matlacha-Pine Island, using the same property tax rate currently being proposed for Matlacha-Pine Island residents by Lee County for FY 2018, will develop a reserve over the first five years after incorporation. It will be up to the elected officials of Matlacha-Pine Island to decide what to do with these reserve funds, including lowering taxes.” On the other hand, Council could decide to raise property taxes if residents support additional services not covered by current tax rates. However, since the Village would no longer be a donor community to Lee County, the tax money saved would likely be sufficient to pay these costs and develop significant reserves.

Q: What could the Council do with the tax money saved by incorporating?

A: According to the Feasibility Study, possible uses of the reserve funds include:

- Reduce the Village tax millage, which could lower the property taxes collected from Matlacha-Pine Island property owners, and reduce the reserves;

- Provide more services requested by residents, thus raising the annual cost of local government and reducing the reserves;

- Create a local Capital Improvement Plan and use the available dollars to build capital projects and reduce the reserves;

- Allow the reserves to remain as projected, providing a financial safety net for the community’s future;

- Some combination of the foregoing options.

Q: Would property taxes be our only revenues?

A: No. As a Village, we would be eligible for state revenue sharing funds, franchise fees from utilities, gasoline taxes, and fees from occupational licenses. We would also be able to negotiate with Lee County for a share of the communication services tax.

Q: Won’t another layer of government just create more bureaucracy?

A: No. A goal of incorporation is a “government lite” concept with minimal elected officials and staff. Seven council members would be elected by the voters, one from each of five districts and two at-large. One of these officials would be elected as Mayor by the Council members. The Council would then take on the policy oversight functions currently held by the Lee County Commissioners. A Village Manager, a Village Clerk/ Treasurer, an Administrative Assistant and a Village Attorney would be employed by the new Village Council to run the day-to-day operations of the city, while the elected officials provided overall guidance and direction. The Council would work with Lee County or other entities to continue to provide public services at current levels.

Q: How much would salaries cost for the officials of the new Village?

A: According to the current Draft Charter (gpica.org/feasibilitystudy2017) each Council member would receive $6,000 per year, and the Mayor, elected by the Council, would receive $9,000 per year. The salaries of the Village Manager, Village Clerk, and Village Attorney would be decided by the Village Council. According to the Feasibility Study, competitive salaries for a City Manager are about $125,000, for a City Clerk/Treasurer $70,000, and for an Administrative Assistant $40,000, with benefits at 35%.

Q: How can we be sure that each of the communities of Greater Pine Island is fairly represented in the new government?

A: The new governing Council would consist of seven Village Council members; five would be chosen in a non-partisan election from five single-member Districts. See a color map of the district boundaries at gpica.org/boundarymaps. The other two Council members would be At-Large Village Council members elected from anywhere in the Village by all the voters. All Council members would be required to reside within the boundaries of the Village (and within their districts) for the duration of their terms.

Q: How would the Districts divided?

A: There would be Five Village Council Districts. Each would be roughly equal in the number of registered voters who reside within Village boundaries and be based on registration information held by the Office of the Lee County Supervisor of Elections. The two At-Large members would be elected by all the voters and could reside anywhere within the new Village boundaries.

Q: Are there potential risks to incorporating?

A: Two areas of concern that residents have raised are the financial costs of lawsuits and the cost of clean-up after a major natural disaster.

- Lawsuits: Some residents are concerned that the new, incorporated Village could face lawsuits filed under the Bert Harris Private Property Rights Protection Act. The State of Florida passed this Act in 1995 and amended it in 2008 and 2011. It provides a process for landowners to seek relief when their property is unfairly affected by government action. However, according to the Florida Bar Journal, “the courts conservatively construe the Act so as not to expose local government to a massive amount of liability.” (https://bit.ly/2WDKs80)

In addition, Lee County specifically revised the Pine Island Planning Community rules in 2016 to avoid the possibility of lawsuits under the Bert Harris Act. And of course, the new Village would no longer share liability for Bert Harris lawsuits with other unincorporated communities in Lee County such as North Fort Myers and Lehigh Acres. Generally speaking, cities face lawsuits of various kinds on a regular basis. All cities plan for this eventuality by employing a City Attorney. The proposed new Village would do the same.

- Hurricane damage: In recent years, we’ve witnessed the destruction caused by hurricanes in other communities. One concern we’ve heard from local residents is how a town with a small budget — or a brand-new town — could afford the cost of debris removal and other cleanup associated with a storm here. After a storm, local government initially pays the costs associated with debris removal and other cleanup either by expending their reserve funds or establishing a municipal bond — essentially taking out a loan. The federal government, through the Federal Emergency Management Agency (FEMA), then reimburses 90 percent of the costs for debris removal and the county pays the remaining 10 percent; those funds would be used to repay the bond. The process, however, can be a lengthy one, with reimbursements taking several years to be received.

Q: Could any of the communities within the proposed Village opt out of incorporation?

A: The Pine Island Planning Community created by the Board of County Commissioners and residents has already designated certain boundaries that by law, must be maintained. All of the smaller communities within these boundaries would pay for services for everyone within the new Village, and all would enjoy the benefits of local control that the new Village would gain from incorporation. That means if the majority of residents of the Greater Pine Island Planning Community vote in favor of incorporation, the new Village will include St. James City, Pine Island Center, Pineland, Bokeelia, Matlacha, and Matlacha Isles. None of these small communities would be able to opt out of incorporation because that would create an unincorporated enclave within an incorporated area, which is not allowed by law.

Q: I have questions not covered here. Who can I contact?

A: This is a living document and we want to update it as new questions arise. Please email info@gpica.org if you have other questions or concerns that are not answered here.